Introduction Fintechzoom Apple Stock

Apple Inc. (AAPL) is a leading technology company known for its innovative products and services, including the iPhone, iPad, Mac, Apple Watch, and a range of software and digital services. Its stock, AAPL, is one of the most closely watched in the financial markets. Fintechzoom provides a wealth of information and analysis on Apple’s stock performance, offering investors valuable insights into its market behavior, financial health, and future prospects. This article delves into Fintechzoom’s coverage of AAPL stock, examining its historical performance, key factors influencing its price, and tools available for investors.

Overview of Apple Stock

- Company Background:

- Apple Inc.: Founded by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple has grown into one of the world’s most valuable and influential tech companies. It is renowned for its innovation, premium products, and strong brand loyalty.

- Market Influence: Apple’s stock is a major component of major stock indices such as the S&P 500 and NASDAQ-100. Its performance often reflects broader market trends and investor sentiment towards the technology sector.

- Historical Performance:

- Growth Trajectory: Apple’s stock has experienced substantial growth over the years, driven by the success of its flagship products, strategic acquisitions, and robust financial performance. Its stock price has been marked by periods of steady growth as well as volatility.

- Key Milestones: Significant milestones, such as new product launches, quarterly earnings reports, and major company announcements, have had notable impacts on Apple’s stock performance. Stock splits and dividend payments are also key events for investors.

Factors Influencing AAPL Stock Prices

- Financial Performance:

- Revenue and Earnings Reports: Apple’s quarterly earnings reports provide critical insights into its financial health, including revenue, net income, and profitability metrics. Strong financial results often lead to positive stock price movements.

- Product Sales: Sales performance of Apple’s key products, such as the iPhone, iPad, and Mac, significantly influences stock prices. High sales figures and strong demand contribute to positive investor sentiment.

- Market Sentiment:

- Investor Sentiment: Perceptions of Apple’s growth potential, innovation, and competitive positioning impact its stock price. Positive sentiment and high expectations can drive up stock valuations.

- CEO Influence: Statements and actions by Apple’s CEO, currently Tim Cook, can affect investor perceptions and stock performance. CEO leadership and strategic decisions play a role in shaping market sentiment.

- Industry Trends:

- Technology Sector: Trends in the technology sector, including advancements in consumer electronics, software, and digital services, influence Apple’s stock performance. Emerging technologies and shifts in consumer preferences impact investor expectations.

- Competitive Landscape: The competitive environment, including the performance of rival tech companies and market share dynamics, affects Apple’s stock price. Innovations and competitive strategies are closely monitored by investors.

- Economic Conditions:

- Macro-Economic Factors: Broader economic conditions, such as interest rates, inflation, and economic growth, can impact Apple’s stock price. Economic downturns or improvements in consumer spending influence stock performance.

- Global Supply Chain: Supply chain issues, such as shortages of key components and materials, can affect Apple’s production capabilities and stock price. The global supply chain environment is crucial for assessing potential risks and opportunities.

Fintechzoom’s Coverage of AAPL Stock

- Real-Time Data:

- Live Quotes: Fintechzoom provides real-time AAPL stock quotes, allowing users to track current prices and monitor market movements. Real-time data is essential for investors and traders needing up-to-date information.

- Historical Data: The platform offers historical AAPL stock data, enabling users to analyze past performance and identify trends. Historical data helps in understanding long-term price movements and making forecasts.

- Analysis and Reports:

- Market Analysis: Fintechzoom delivers detailed market analysis on AAPL stock, including technical analysis, price trends, and market forecasts. These insights help users understand the factors driving price changes and make informed decisions.

- Research Reports: Subscribers to Fintechzoom can access comprehensive research reports on Apple’s financial performance, market position, and industry trends. These reports provide valuable context for strategic investment planning.

- Interactive Tools and Resources:

- Price Charts: Fintechzoom features interactive price charts for AAPL stock, allowing users to visualize price movements over different time frames. Users can customize these charts with various technical indicators for deeper analysis.

- Alerts and Notifications: The platform enables users to set up alerts and notifications for significant price changes or market events related to AAPL. This feature helps users stay informed and act promptly on relevant developments.

Investment Strategies for AAPL Stock

- Growth Investing:

- Long-Term Prospects: Apple is often viewed as a growth stock with substantial long-term potential. Investors focusing on growth may consider holding AAPL stock for extended periods, capitalizing on the company’s innovation and market expansion.

- Valuation Considerations: Growth investors should evaluate Apple’s valuation relative to its earnings growth and market potential. Metrics such as price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio are useful for assessing valuation.

- Dividend Investing:

- Dividend Payments: Apple is also a dividend-paying stock, and its consistent dividend payments attract income-focused investors. Assessing dividend yield and payout ratios can be important for investors seeking regular income.

- Dividend Growth: Investors may consider Apple’s track record of dividend growth as an indicator of financial health and commitment to returning value to shareholders.

- Technical Analysis:

- Chart Patterns: Utilizing technical analysis tools provided by Fintechzoom, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), can help traders identify trends and potential trading opportunities for AAPL stock.

- Trading Strategies: Technical analysis can assist in implementing strategies such as trend following or swing trading. Traders should use these tools to make informed decisions based on market data and price patterns.

Challenges and Considerations

- Market Volatility:

- Price Swings: AAPL stock is known for its volatility, characterized by significant price swings driven by market sentiment and news. Investors should be prepared for potential volatility and adjust their strategies accordingly.

- Speculative Risks: Apple’s stock price can be influenced by speculative trading and short-term market trends. Investors should conduct thorough research and consider long-term fundamentals when making investment decisions.

- Financial Risks:

- Company Performance: Apple’s financial performance, including its ability to manage production, costs, and competition, can impact its stock price. Investors should monitor financial reports and assess the company’s financial health.

- Industry Risks: Risks related to the technology sector, such as regulatory changes, technological advancements, and competitive pressures, can affect Apple’s performance and stock valuation.

Future Trends and Developments

- Technological Innovations:

- Product Advancements: Apple’s ongoing innovations in technology, including new product releases and software developments, may drive future stock performance. Staying updated on new product announcements and technological advancements is crucial for investors.

- Sustainability Initiatives: Developments in sustainability and environmental initiatives could impact Apple’s market position and stock valuation. Investors should monitor Apple’s efforts in these areas.

- Market Dynamics:

- Global Expansion: Apple’s expansion into new markets and growth in international sales can influence its stock performance. Investors should keep track of the company’s global growth strategy and its impact on revenue.

- Competitive Landscape: The competitive landscape in the technology sector, including the emergence of new competitors and advancements by existing players, can affect Apple’s market share and stock price.

Apple’s Historical Stock Performance

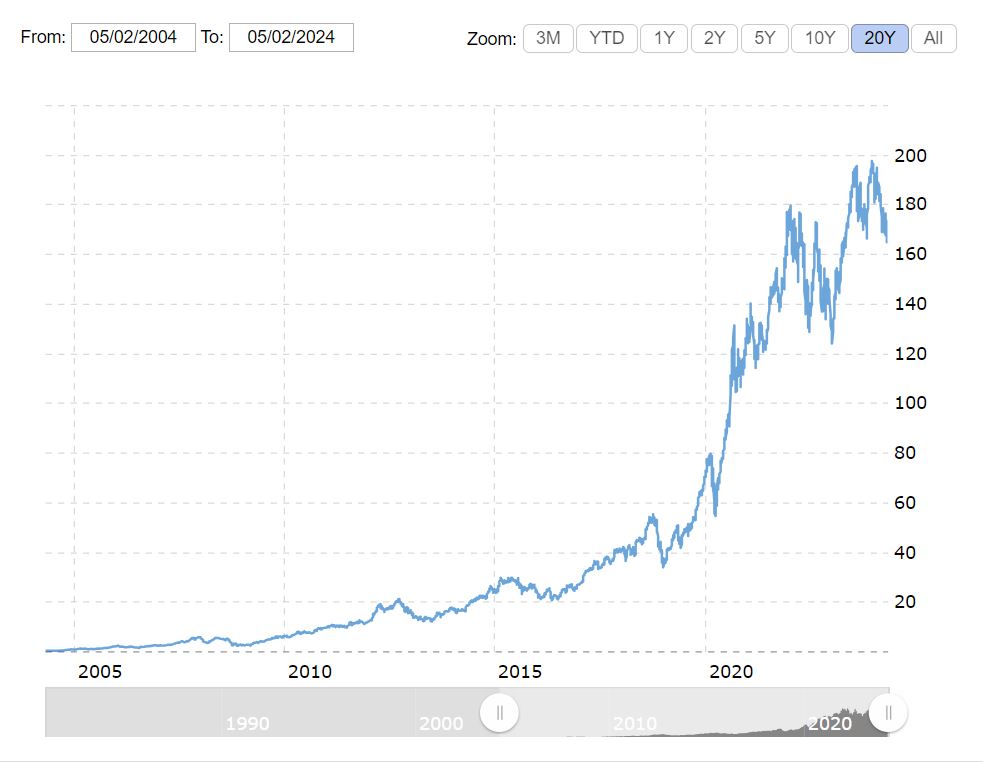

Over the decades, Apple’s historical stock performance has demonstrated a remarkable trajectory marked by consistent growth and resilience in the face of market fluctuations. The Fintechzoom apple stock analysis reveals a decade-long trend of upward movement, showcasing Apple’s ability to weather market volatility.

Apple’s stock has been a notable performer, reflecting the company’s innovative products and strong financials. The consistent growth in Apple’s stock price has been influenced by various factors, including successful product launches, robust sales figures, and strategic business decisions.

Investors tracking Fintechzoom apple stock have witnessed the impact of Apple’s historical performance on market sentiment and investor confidence. The detailed earnings reports coverage has provided insights into the company’s financial health and future prospects, contributing to the overall positive trajectory of Apple’s stock.

As Apple continues to evolve and expand its product offerings and services, the historical stock performance serves as a confirmation to the company’s ability to deliver value to its shareholders amidst changing market dynamics.

Analyst Ratings and Target Prices

Continuing to assess Apple’s performance beyond historical trends, the current focus shifts towards analyzing Analyst Ratings and Target Prices for AAPL stock. Analyst Ratings play a vital role in guiding investors by providing insights into the potential future performance of a stock.

These ratings are often based on in-depth analysis of various factors, including company financials, market trends, and industry competition. Additionally, Target Prices offer a specific price level at which analysts believe the stock is fairly valued or should be traded in the future. Investors frequently consider these target prices when making decisions about buying, selling, or holding a stock like Apple.

Fintechzoom‘s apple stock price prediction section may contain a range of analyst ratings and corresponding target prices for AAPL stock. This data can be invaluable for investors seeking to make informed decisions based on expert opinions and market insights.

By incorporating these ratings and target prices into their investment strategies, individuals can better navigate the dynamic landscape of the stock market and potentially optimize their returns.

Decade-Long Stock Growth Analysis

Across the past decade, Apple’s stock has exhibited remarkable and sustained growth, reflecting the company’s consistent performance in the market. This growth can be attributed to several factors, including Apple’s ability to innovate and adapt to changing market conditions.

Despite facing challenges such as market volatility and competition, Apple has managed to maintain a steady upward trajectory in its stock value. The company’s focus on delivering high-quality products and services, coupled with its strong brand reputation, has contributed to investor confidence and loyalty over the years.

Other stock companies that want to stand firm in this market can also learn from Apple’s contribution to maintaining customer loyalty by providing high-quality products and services. For example, you can customize gifts for customers. Custom Pens is a good choice. Engrave the company’s logo and other information on the pen body, which not only improves customer satisfaction, but also increases brand awareness to a certain extent.

Furthermore, Apple’s strategic decisions, such as expanding into new markets and diversifying its product portfolio, have also played a significant role in driving stock growth. By consistently meeting or exceeding market expectations and demonstrating resilience in the face of economic uncertainties, Apple has established itself as a reliable investment option for many stakeholders. Moving forward, continued emphasis on innovation and customer-centric strategies will likely be key drivers of Apple’s stock growth in the years to come.

Impact of Product Launches

Amidst Apple’s sustained stock growth over the past decade, a pivotal factor influencing its market performance is the impact of new product launches on the company’s stock price. Apple’s stock price tends to react markedly to the introduction of new products, reflecting investor expectations and market sentiment surrounding these launches.

Historically, highly anticipated products like the iPhone, iPad, and Apple Watch have driven both consumer interest and investor confidence, leading to surges in stock value. Conversely, product launches that do not meet expectations or face challenges in the market can result in temporary dips in Apple’s stock price as investors reevaluate their positions.

Conclusion

Fintechzoom offers a comprehensive suite of tools and resources for analyzing Apple (AAPL) stock, providing valuable insights for investors and traders. With real-time data, advanced analytical tools, expert opinions, and detailed research reports, Fintechzoom empowers users to make informed decisions in the Apple stock market. By staying updated on market trends and leveraging the platform’s resources, users can navigate the complexities of investing in AAPL stock and capitalize on opportunities in the evolving financial landscape.